Article by Steve Voynick

Mining – June 2006 – Colorado Central Magazine

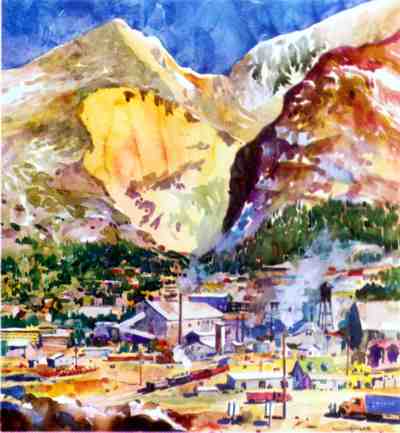

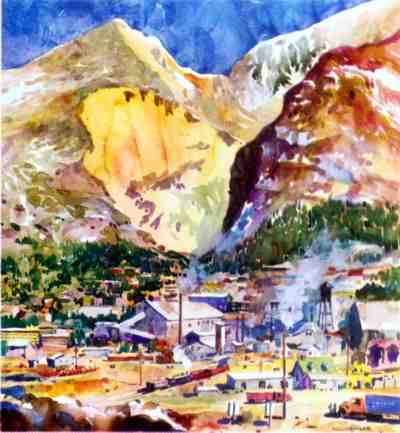

ALTHOUGH I HAD heard rumors of dancing in the streets, I didn’t see it myself, at least not on Harrison Avenue. But judging from the banner headlines in the Herald Democrat and the joyful comments of Lake County’s commissioners, Leadville’s mayor, and dozens of local merchants and residents, salvation is nearly at hand. And in Leadville, salvation means only one thing: the reopening of the Climax Mine.

On April 5, 2006, the Phoenix-based Phelps Dodge Corporation, owner of Climax, announced its intent to restart the mine. But don’t rush up to Frémont Pass just yet to apply for work. Phelps Dodge says that the reopening is contingent upon a final feasibility study and the acquisition of regulatory approval and required operating permits.

So how far away is salvation? Well, if salvation means paychecks and higher county tax revenues, then it will be 18 months before construction of new surface facilities begins and more than three years before a new mill ships its first sack of molybdenite concentrate.

That may seem a long time to wait. But just two years ago, any possible Climax reopening was pegged at 20 years down the line. From that perspective, the Climax restart is now just around the corner.

Of course, Leadville has been down this road before. During the 1980s when Climax was an AMAX property, it went through two short-lived and very limited openings. Then, in 1995, new owner Cyprus-AMAX restarted the mine again in another ill-fated response to a temporary rise in molybdenum prices.

But this restart looks like the real thing, and here’s why. This is not just another move to generate corporate cash flow by taking advantage of high molybdenum prices. If that were the case, Climax would have reopened three years ago using its existing mill. This restart reflects thoughtful, long-term corporate planning in which all the pieces seem to be falling into place.

THREE MAIN FACTORS make this restart different from the failed effort of 1995 and those that preceded it: a booming, restructured molybdenum market; the strong cash position and insightful management philosophy of the Phelps Dodge Corporation; and the sudden, sharp reduction in the projected life of Phelps Dodge’s Henderson molybdenum mine located near Empire, Colorado.

Hopes that Climax would reopen have been building in Leadville for several years, thanks to rising moly prices (see “Moly and the Future of Climax,” Colorado Central, July 2005). But before analyzing the announced re-opening, let’s first clarify the matter of moly prices which, while often quoted, are not always understood.

Moly prices are expressed on a per-pound basis and refer to one pound of elemental (metallic) molybdenum as contained in molybdic trioxide (MoO3). Moly ore contains the mineral molybdenite, or molybdenum disulfide (MoS2), usually in quantities of less than one percent. After mining, the finely ground ore goes through a flotation-separation process that produces an 85-percent molybdenite concentrate. This is shipped to conversion plants where it is purified and roasted into molybdic oxide, the basic feedstock for manufacturing most molybdenum-containing products. Moly mines profit when their overall costs of mining, milling, and converting a pound of moly is less than the market price.

During the 20 years that followed the 1981 moly-market crash and the initial suspension of production at Climax, cash-production costs for a pound of moly were about $4 to $5. Meanwhile, moly prices ranged between $2.50 and $6, while averaging about $4, too low to justify continuous mining.

After bottoming out at just $2.50 per pound in 2002, moly prices rose to $6 in 2003 on their way to a record high of $38.50 in mid-2005. As of May 1, 2006, the price had settled back to $24 — still high enough to assure moly miners of big profits. Given these prices, Climax could have been operating profitably since 2003.

But Climax was not reopened because of its subordinate relationship to the Henderson Mine, which works a large molybdenite deposit within Red Mountain, near U.S. Highway 40 roughly midway between Empire and Berthoud Pass. The Primos Chemical Company first mined this deposit briefly during World War I, the same time that the Climax Molybdenum Company got its start near Leadville.

AFTER WORLD WAR I, Primos quickly faded into history, while Climax went on to grand achievements, becoming a huge moneymaker and, by the 1950s, the world’s largest underground mine. In 1957, the original Climax Molybdenum Company merged with the American Metal Company to form American Metal Climax, which soon adopted the corporate acronym AMAX. To generate the cash flow necessary to pay for its grand diversification and expansion plans, AMAX immediately began pushing the Climax Mine to unprecedented production levels.

During the early 1960s, AMAX geologists exploring Red Mountain discovered a large molybdenite body at depth. In 1968, AMAX announced its plans to develop this deposit with a major, modern mine and mill named the Henderson Project, after former Climax resident manager Robert Henderson.

To provide the $500 million needed for Henderson, AMAX ordered Climax into hurried development of an open pit and increased underground production. In 1976, Climax, even with its richest ore gone, set its all-time annual production record — a phenomenal 60 million pounds of moly.

Meanwhile, in 1974, AMAX had leased an unproven moly deposit at Mt. Emmons, near the former coal-mining town of Crested Butte, then undergoing revival as a skiing and resort town. A few years later, AMAX invested $150 million in cash and advanced royalty payments on future production to buy and explore eight square-miles of claims. Mt. Emmons seemed like a smart investment when AMAX geologists proved the existence of a major moly deposit.

In 1980, the Henderson Mine reached its planned production rate, displacing Climax as the AMAX crown jewel. With operating mines at Climax and Henderson, and production at Mt. Emmons just eight years away, AMAX’s continued domination of the moly market seemed certain.

But those plans fell apart with the calamitous 1981 moly-market crash. AMAX shelved its Mt. Emmons development plans and suspended production at both Climax and Henderson for two years. Henderson resumed steady, but limited, production in 1984, while Climax produced only sporadically through the 1980s, not because moly prices justified it, but because AMAX desperately needed cash.

IN 1993, Cyprus Minerals, primarily a copper-mining company, bought out what was left of AMAX to form Cyprus-AMAX Minerals. Also cash deficient, Cyprus-AMAX quickly reopened Climax in 1995 in response to a moly price spike, only to shut it down six months later. It then became clear that Climax would not produce again until Henderson ran out of ore, perhaps in 25 or 30 years.

Just as Cyprus Minerals had swallowed AMAX, Cyprus-AMAX was swallowed six years later by a much bigger fish — the Phelps Dodge Corporation. Phelps Dodge was founded in 1834 in New York City as a metal importer. In 1881, it bought into Arizona copper mining; 25 years later, it abandoned the import business to concentrate entirely on copper mining and milling. Later, Phelps Dodge broadened its interests into copper refining and manufacturing, and picked up mine holdings in Chile. During the bitter Arizona copper-mine strike of 1983, Phelps Dodge showed its corporate backbone, breaking a troublesome union with a ruthless show of defiance that still impacts labor-management relations in the metal-mining industry today.

Perhaps the most telling testimony to the corporation’s business acumen is that, even after 125 years in mining, Phelps Dodge is still Phelps Dodge, while AMAX, Cyprus Minerals, and Cyprus-AMAX have all fallen by the wayside.

The acquisition of Cyprus-AMAX in 1999 gave Phelps Dodge additional copper properties in Chile, Peru, and Arizona. The acquisition also included such moly interests as the break-even Henderson Mine, the inactive Climax Mine, and a potential future mine site at Mt. Emmons. Since the moly market was still depressed, Phelps Dodge kept Henderson producing well below capacity, while Climax remained inactive.

Then the moly market suddenly roared to life in 2002. Within a year, it became clear that the rising moly prices were not a temporary spike, but a major trend that was likely to continue.

But rather than quickly re-opening Climax, Phelps Dodge instead invested $85 million to boost production at Henderson. By late 2006, Henderson will have doubled its annual moly production to 40 million pounds.

Should Phelps Dodge also have restarted Climax in 2003? No. That would not have been the Phelps Dodge style. Unlike the old AMAX and Cyprus-AMAX operations, Phelps Dodge had no need to generate immediate cash flow from a jury-rigged moly operation. Not only would it have been saddled with an outdated and inefficient mill, but Climax production, even at only 10 million pounds annually, would have tempered the moly price, thus effectively reducing the big profits generated by Henderson.

NOW, HOWEVER, the doubling of production at Henderson has suddenly cut its projected life to just ten years. And that has big implications for Climax. If Climax is to carry the ball after Henderson runs out of ore, then Phelps Dodge must soon begin to prepare Climax.

Judging from its preliminary construction and production schedule, Phelps Dodge is in no rush to bring Climax on-line. And its willingness to invest as much as $250 million into new mine facilities indicates that it intends to do the job right.

Phelps Dodge, again unlike AMAX and Cyprus-AMAX, is dealing from a position of considerable financial strength. Since 2002, moly prices have increased nearly ten-fold. And if that isn’t enough, the price of copper, Phelps Dodge’s bread and butter, has tripled to record highs in the past three years. In 2005, Phelps Dodge posted revenues of more than $8 billion and an operating income of $1.7 billion. Its stock prices have doubled in the past 12 months and the corporation recently declared a special shareholder dividend of $400 million. So Phelps Dodge won’t have to dig very deep to come up with $250 million for new Climax facilities.

BUT WHY DID Phelps Dodge announce the Climax reopening 3½ years in advance? Analysts at Metal Bulletin magazine believe that this unusually early announcement is intended to make would-be competitors think twice before investing big bucks in new moly mines. And the thought of a rejuvenated Climax coming on-line at 20 million pounds of moly per year will likely do just that.

Ultimately, of course, everything hinges on moly prices. Today’s moly market is riding strong, broad-based demand from Asia, Europe, and the United States. It is sustained primarily by booming industrial growth in China and India, and by big purchases of high-moly, steel-alloy pipe for oil-field drilling and pipeline use by the worldwide petroleum and natural-gas industries.

That the moly price has in the past year settled back to $24 reflects not weakening demand, but adjustment to an increasing global moly supply. During 2005, moly production in the United States, the world’s leading producer which accounts for one-third of world output, increased by nearly 40 percent. Most analysts project that over the long term moly prices will stabilize in the $15-20 range — more than high enough to ensure the profitability of future moly mining.

On paper, comparing low cash production costs against the high price of moly seems to indicate an astronomical profit, especially when considered in the context of 20 million or so pounds of moly per year. But this reflects operating profit only, and many other major costs lurk in the shadows. At Climax, a few examples will include recouping the $250-million cost of the new mill, huge end-of-mine reclamation costs, and several millions more each year to maintain water quality in the Climax drainage in perpetuity.

And what of the Mt. Emmons deposit? From the earliest involvement of AMAX at Mt. Emmons in the 1970s, tourism-oriented Crested Butte has been adamantly opposed to a mine. The anti-mining sentiments subsided somewhat after the 1981 moly-market collapse. But the grassroots resistance erupted again when Phelps Dodge acquired the Mt. Emmons property in 1999 and quickly secured additional water rights, ostensibly to support a future mining project.

THEN IN 2004, Phelps Dodge patented some of its Mt. Emmons claims, citing the strong moly market to satisfy the government’s requirement that the claims be “economic.” In Crested Butte, the old “Don’t Climax Crested Butte” bumper stickers reappeared, while various community groups reorganized to fight any proposed mine.

But in March 2006, to the surprise of many, Phelps Dodge exercised a court ruling that allowed it to return the Mt. Emmons property to its owners, U.S. Energy Corporation and its subsidiary Crested Corporation. Walking away from a world-class moly deposit while moly prices are soaring is not easy to explain — until one considers the bigger picture.

Phelps Dodge already has a big moly presence in Colorado, with Henderson approaching maximum production and Climax now preparing to reopen. And the corporation does have a favorable image to protect. Today, Phelps Dodge is far better-known not for its controversial role in the 1983 Arizona copper strike, but for its ranking in Fortune magazine’s “Most Admired” list of corporations, where it earns high marks in such areas as innovation, use of corporate assets, social responsibility, and quality of management.

Any company that tries to mine Mt. Emmons (and U.S. Energy Corporation is currently seeking a partner with deep pockets to do just that) is going to face nasty, lengthy battles in state and federal courts and in the court of public opinion. Even if a mining company wins the legal battle to mine Mt. Emmons, its image will surely suffer. So why should Phelps Dodge take on a fight in Crested Butte, when Leadville will welcome it with open arms?

Remember, too, that even after many decades of large-scale mining, Climax still has an estimated 460 million pounds of recoverable moly — nearly twice the amount at Mt. Emmons.

IN RECENT YEARS I’ve heard comments that Leadville is no longer a mining town, that it’s a bedroom community, a tourist town, or a combination thereof. True, Leadville’s last working mine, ASARCO’s Black Cloud lead-zinc-silver-gold operation, closed in 1999. But ever since Phelps Dodge’s announcement that it would study a possible Climax reopening, moly prices have been a hot topic of conversation along Harrison Avenue.

After Phelps Dodge announced its conditional intent to reopen Climax, I solicited reactions in Leadville. Beyond the obvious concerns about how Leadville would or should adjust to a new economic scenario, I found no opposition at all to the reopening, and certainly not on the grounds that it might discourage tourism or upset the status quo of housing in the “bedroom community.”

Even the most militant environmentalists will have a hard time justifying opposition to a Climax reopening. The 70-square-mile Climax property has already been heavily impacted by 90 years of mining, so another 20 years of digging won’t make much difference. And, from the standpoint of resource conservation, it certainly makes sense to finish the job of mining an already disturbed site before digging into an untouched deposit elsewhere.

For Climax, Leadville, and Phelps Dodge, everything seems to be falling into place nicely. The moly market is right, the corporate timing is right, and the place is right. So, as Phelps Dodge prepares to write a new chapter at Climax, Leadville is again looking forward to salvation in the form of mining paychecks.

It seems that Leadville is about to become one of the very few western mining towns to ever get a second chance from the mining industry. This time around, after looking at its own past mistakes, Leadville will hopefully be much better prepared for the day, perhaps 20 years down the line, when Climax finally mines what will really be that last ton of ore.

Steve Voynick of Twin Lakes once mined and mucked at Climax, and is the author of Climax: A History of Colorado’s Climax Molybdenum Mine.